Written by: Zoey Ye Zhang, Asia Briefing, Dezan Shira & Associates

The 2019 editions of China’s National and FTZ Negative Lists and FI Encouraged Catalogue are important supplements to the upcoming Foreign Investment Law.

The 2019 editions of China’s National and FTZ Negative Lists and FI Encouraged Catalogue are important supplements to the upcoming Foreign Investment Law.

China Briefing explains the new changes and identifies the industries where China restricts or encourages foreign investments.

On June 30, 2019, the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOF) jointly issued two “negative lists” and one “encouraged catalogue”, all three of which will take effect on July 30, 2019.

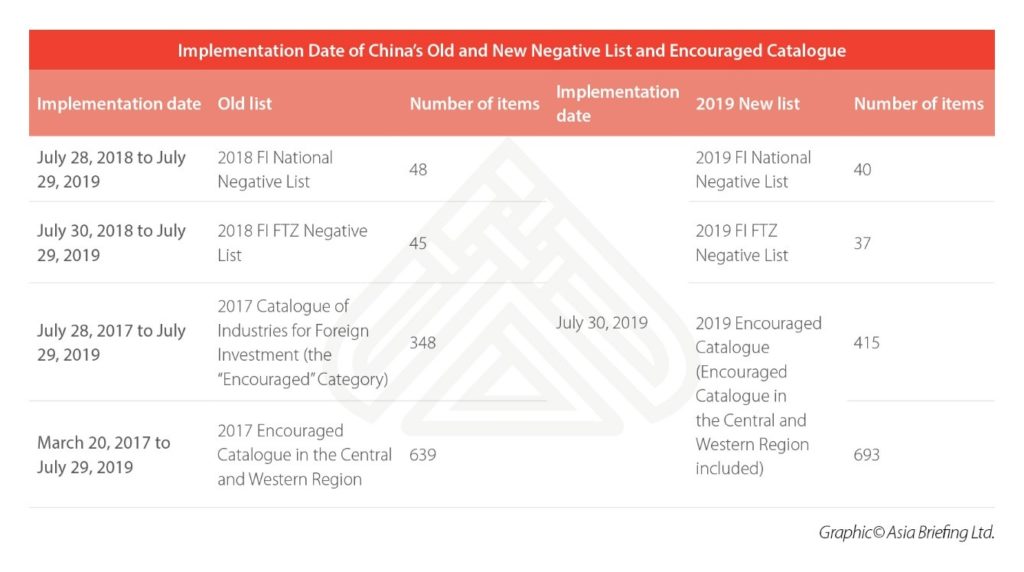

The two Negative Lists refer to the Special Administrative Measures on Access to Foreign Investment (2019 edition) (“2019 FI National Negative List”) (full list in Chinese available here) and the Free Trade Zone Special Administrative Measures on Access to Foreign Investment (2019 edition) (“2019 FI FTZ Negative list”) (full list in Chinese available here), which will replace their respective 2018 versions.

These two negative lists enumerate the industries where foreign investment will either be prohibited or restricted.

The respective lists will be applicable in different areas – the FTZ list is for pilot free trade zones and the national list is for the rest of the country.

Besides the lists, the new Encouraged Catalogue, or the Catalogue of Encouraged Industries for Foreign Investment (2019 edition) (“2019 FI Encouraged Catalogue”) (full list in Chinese available here), lists industries where foreign knowhow and investment is welcome.

The 2019 FI Encouraged Catalogue will replace the 2017 editions of the “encouraged category” of the Catalogue of Industries for Foreign Investment and the Catalogue of Encouraged Industries in the Central and Western Region.

The newly released lists and catalogue will assist foreign investors when evaluating investments or market entry into China as they can assess whether their business will be permitted and can enjoy preferential policies from the government.

Overall, the 2019 FI negative lists have been shortened, while the encouraged catalogue has been extended.

Simply put, there are fewer sectors where foreign investment will be restricted and more sectors where it will be encouraged. This bodes well for further market openings in China.

Major changes to the negative lists

Compared with the 2018 version, the number of items on the 2019 FI negative lists has reduced from 48 to 40 in the national list, and 45 to 37 in the FTZ list. No new item has been added.

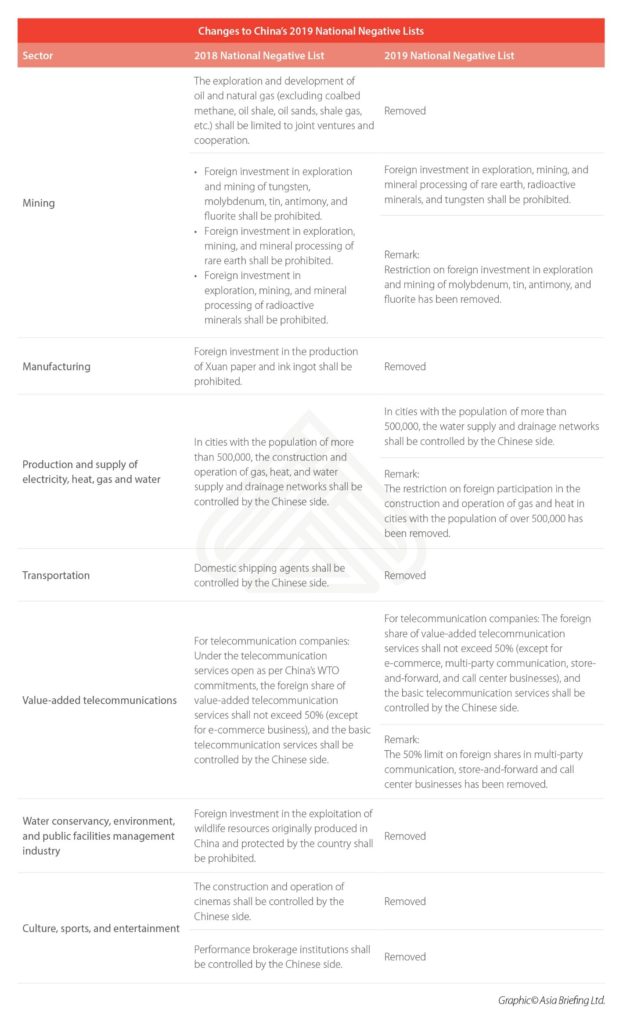

The 2019 FI national negative list further opens up the services, agriculture, mining, and manufacturing sectors.

New opening-up measures will allow majority foreign ownership or wholly owned foreign enterprises in sub-sectors, such as the exploration and development of oil and natural gas, production and supply of heat and gas, value-added telecommunications, shipping business, manufacturing of Xuan paper and ink ingot, exploitation of wildlife resources, and operation of cinemas, as the table shown below.

Similar changes can also be seen in the FTZ list, although this list is less restrictive.

Similar changes can also be seen in the FTZ list, although this list is less restrictive.

The FTZ negative list further opens up another two industries – the fishing industry (by lifting the ban on investment in fishing products within China’s territory) and the printing industry (by removing restrictions on ownership of press publications).

For industries not included in the negative list, foreign and domestic investors shall enjoy equal access under the law, save for record-filing requirements.

For industries not included in the negative list, foreign and domestic investors shall enjoy equal access under the law, save for record-filing requirements.

No region or department may impose separate restrictions on foreign investment in areas not on the negative list.

As over the last several years, both the national list and FTZ list have been greatly reduced – the number of items in the national list fell from 180 in 2011 to 40 in 2019 and items on the FTZ list fell from 190 in 2013 to 37 in 2019.

This shows that China is opening more industries to foreign investment.

Major changes introduced in the new encouraged catalogue

Major changes introduced in the new encouraged catalogue

The 2019 FI Encouraged Catalogue consists of two sub-catalogues – one applies to the whole country and one is applicable to 22 provinces in China’s central, western, and northeastern regions (“FI Encouraged Catalogue in the Central and Western Region”).

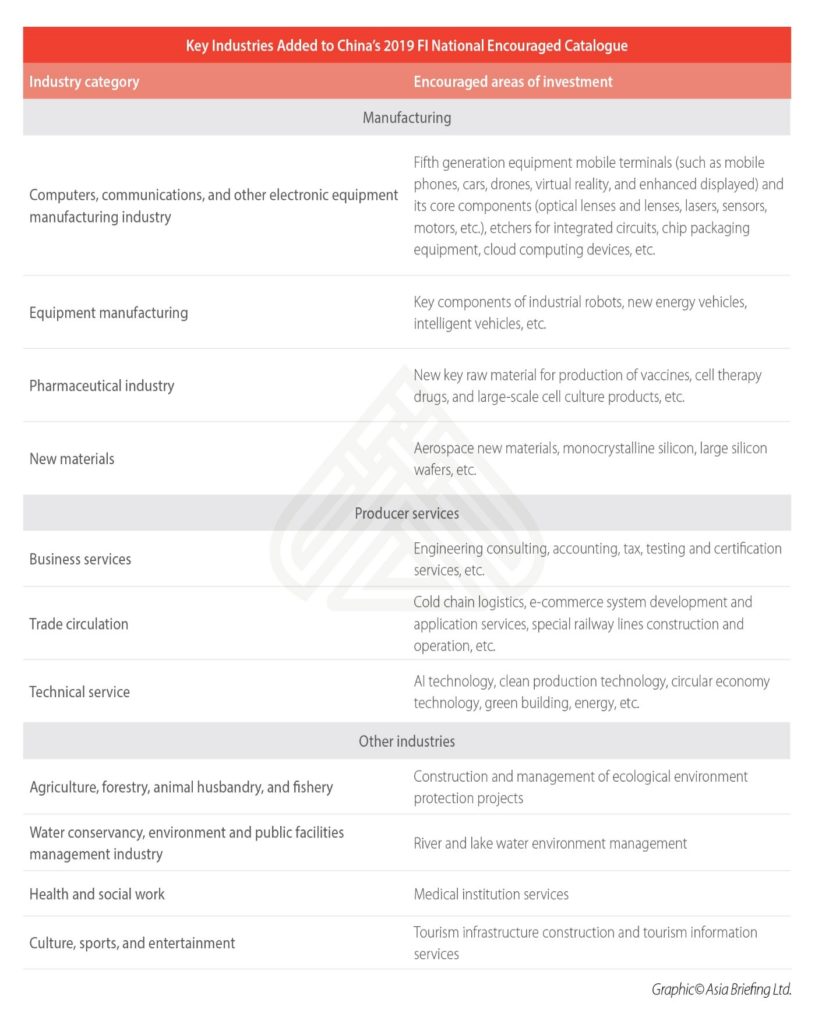

Nationwide, the number of encouraged industries has increased from 348 to 415, with 67 items added and 45 items revised, compared with 2017.

Sectors such as modern agriculture, advanced manufacturing, high and new technology, energy conservation and environmental protection, and the modern service industry especially welcome foreign investment.

Among them, investments in manufacturing industries are encouraged, which account for 80 percent of the added or modified items. The high-end manufacturing, smart manufacturing, and green manufacturing industries are highly valued.

Region-wise, in the sub-catalogue of China’s 22 provinces, encouraged items have been increased from 639 to 693, with 54 items added and 165 items revised, compared with 2017.

Region-wise, in the sub-catalogue of China’s 22 provinces, encouraged items have been increased from 639 to 693, with 54 items added and 165 items revised, compared with 2017.

Foreign investors are more encouraged to transfer their investment to the central and western regions, such as Anhui, Hunan, Sichuan, Henan, Yunnan provinces, and Inner Mongolia.

Foreign-funded projects that fall under the encouraged catalogue will be eligible for preferential treatment, such as tax incentives, streamlined approval procedures, and discounted land prices.

Foreign-funded projects that fall under the encouraged catalogue will be eligible for preferential treatment, such as tax incentives, streamlined approval procedures, and discounted land prices.

How to use the negative lists and encouraged catalogue

To be noted, foreign investors investing in China are regulated not only by the negative lists addressing foreign investment access, but also by other negative lists applicable to domestic enterprises.

For example, the Negative List for Market Access (2018 edition) (“2018 MA Negative List”), which categorizes “prohibited” and “restricted” industries for all foreign and domestic investment – is another list foreign investors must check.

Moreover, foreign investors should also be aware that for some industries on the negative lists or even the encouraged catalogue, there may still be a set of examination and approval conditions and procedures that companies need to secure from relevant authorities. Seeking local expertise is advised.

This article was first published by China Briefing, which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in in China, Hong Kong, Vietnam, Singapore, India, and Russia. Readers may write info@dezshira.com for more support.