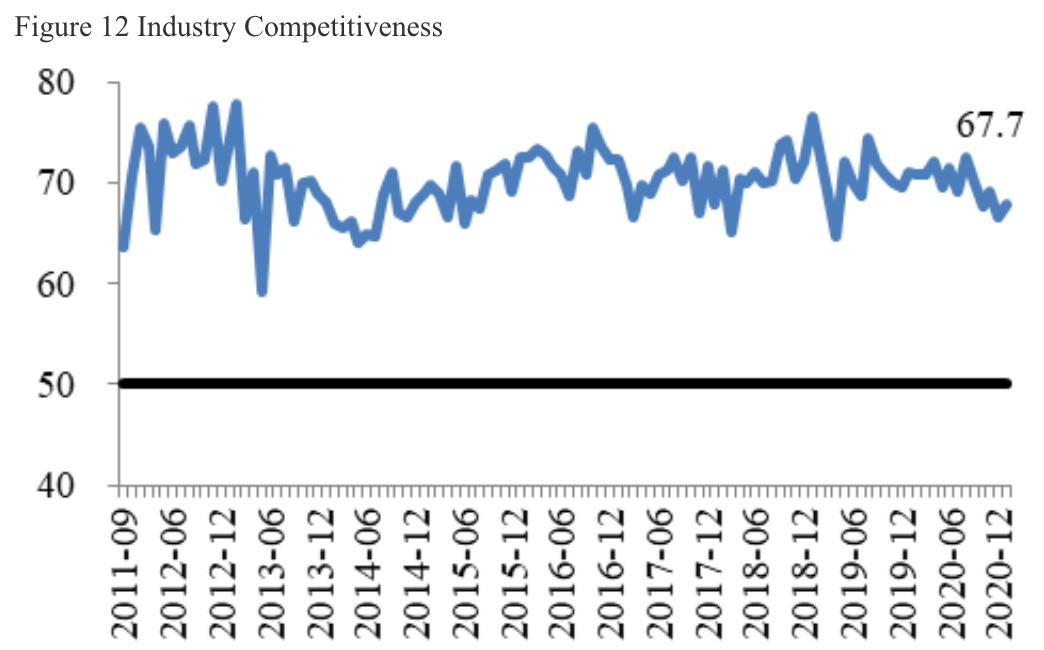

In January, the CKGSB Business Conditions Index (BCI) registered 57.2, a slight improvement in December’s figure of 55.5 (Figure 1).

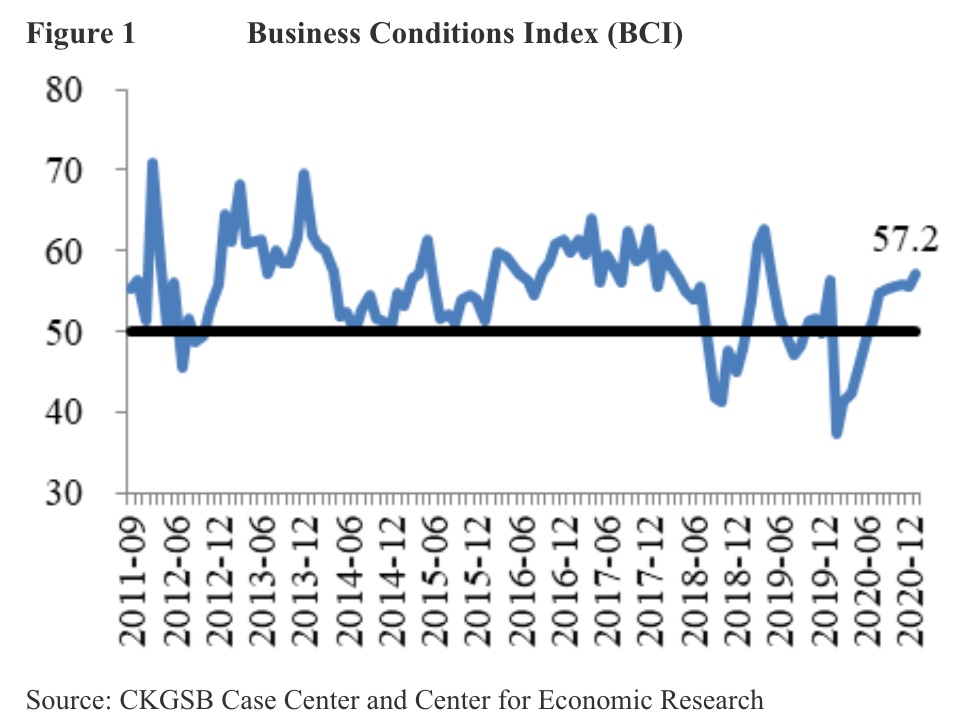

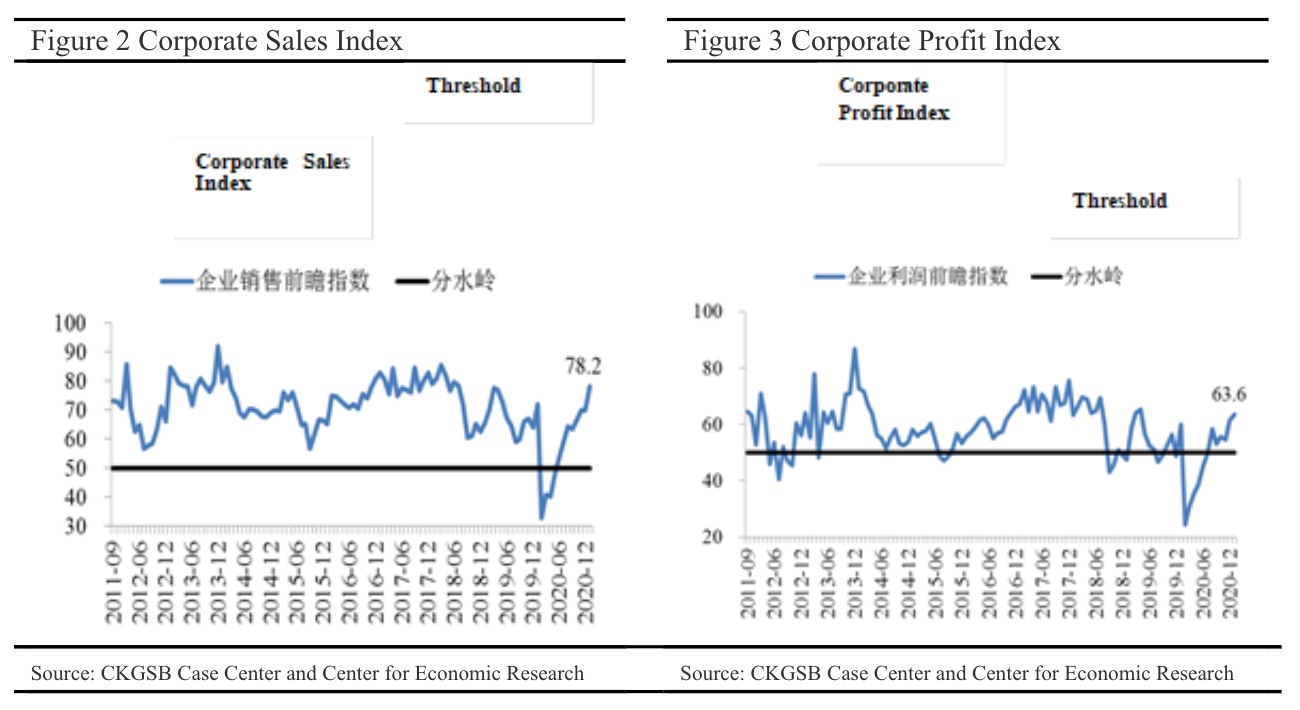

The CKGSB BCI comprises four sub-indices: corporate sales, corporate profits, corporate financing environment and inventory levels. Three measure future prospects and one, the corporate financing index, measures the current climate. In January 2021, these sub-indices performed as follows:

This month, three of these sub-indices rose and one fell. The corporate sales index rose from 69.85 to 78.2 (Figure 2), and the corporate profit index rose from 61.5 to 63.6 (Figure 3).

Corporate financing prospects rebounded somewhat, with the index rising slightly to 48.1 from 47.4 last month (Figure 4), keeping the level of confidence under the threshold. The inventory index kept on trend from last month, falling from 43.5 to 41.0 (Figure 5). These two indices have been problematic since the start of our survey in 2012, showing persistently negative outlooks

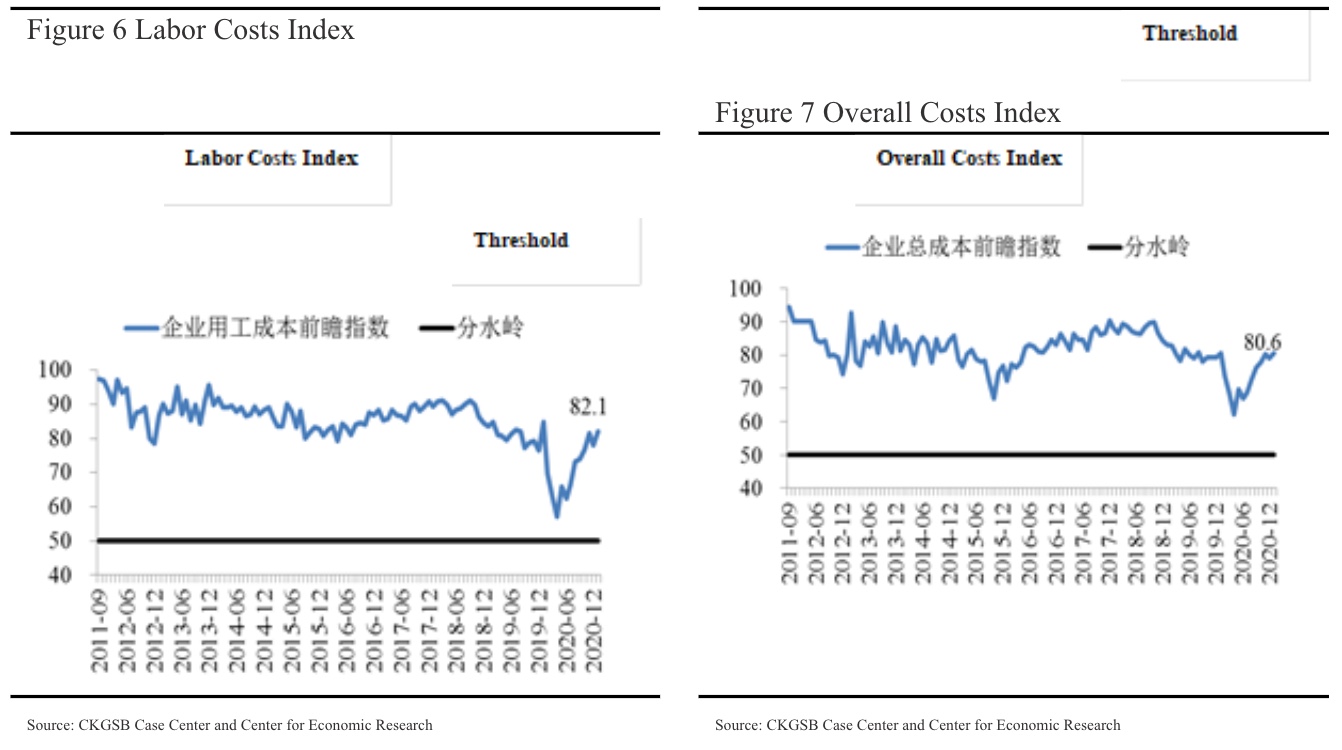

Aside from the main BCI, we also forecast costs, prices, investment and recruitment demand over the next six months. We begin with costs:

This month’s labor cost forecast returned from 78.0 to 82.1. Overall costs prospects rose ever so slightly, in this case from 79.1 to 80.6. See Figures 6 and 7 for more.

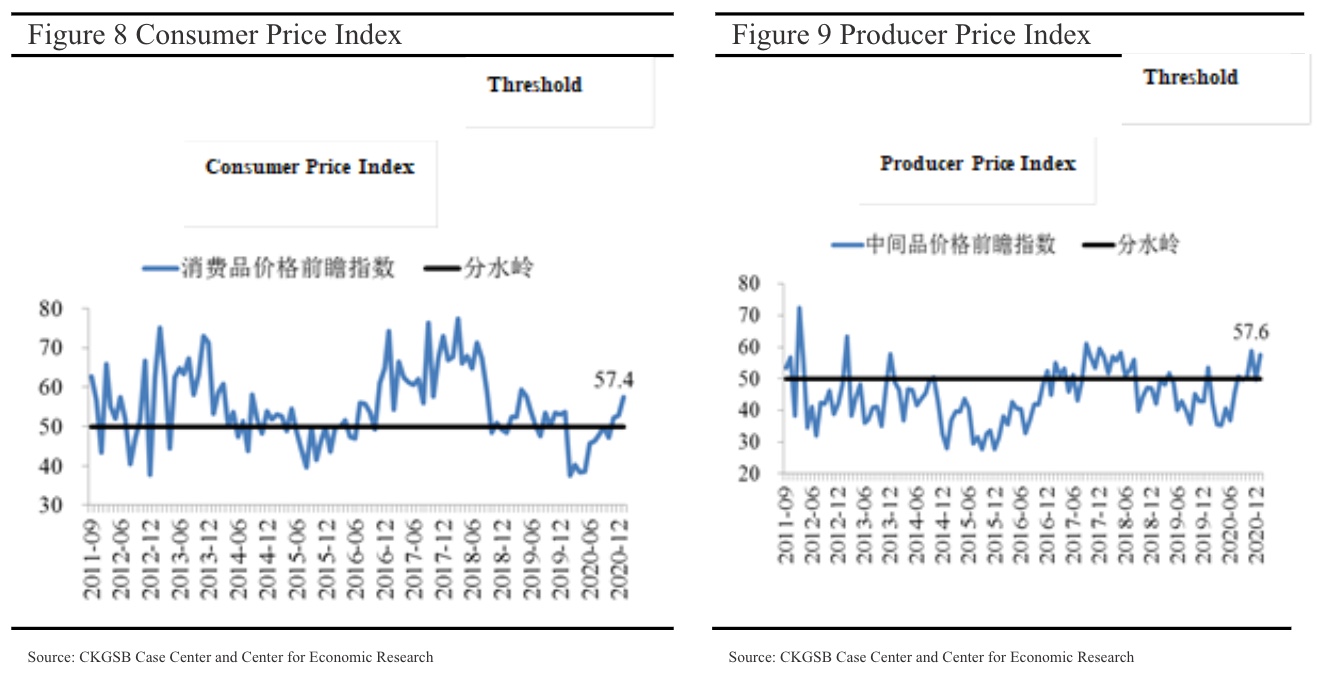

Turning to prices, the consumer price forecast rose from 52.8 to 57.4 (Figure 8) while the producer price index rose from 49.7 to 57.6 (Figure 9), wiping out last month’s gains. This sees producer price prospects again move higher than the consumer price index, something that is rare to see in the BCI.

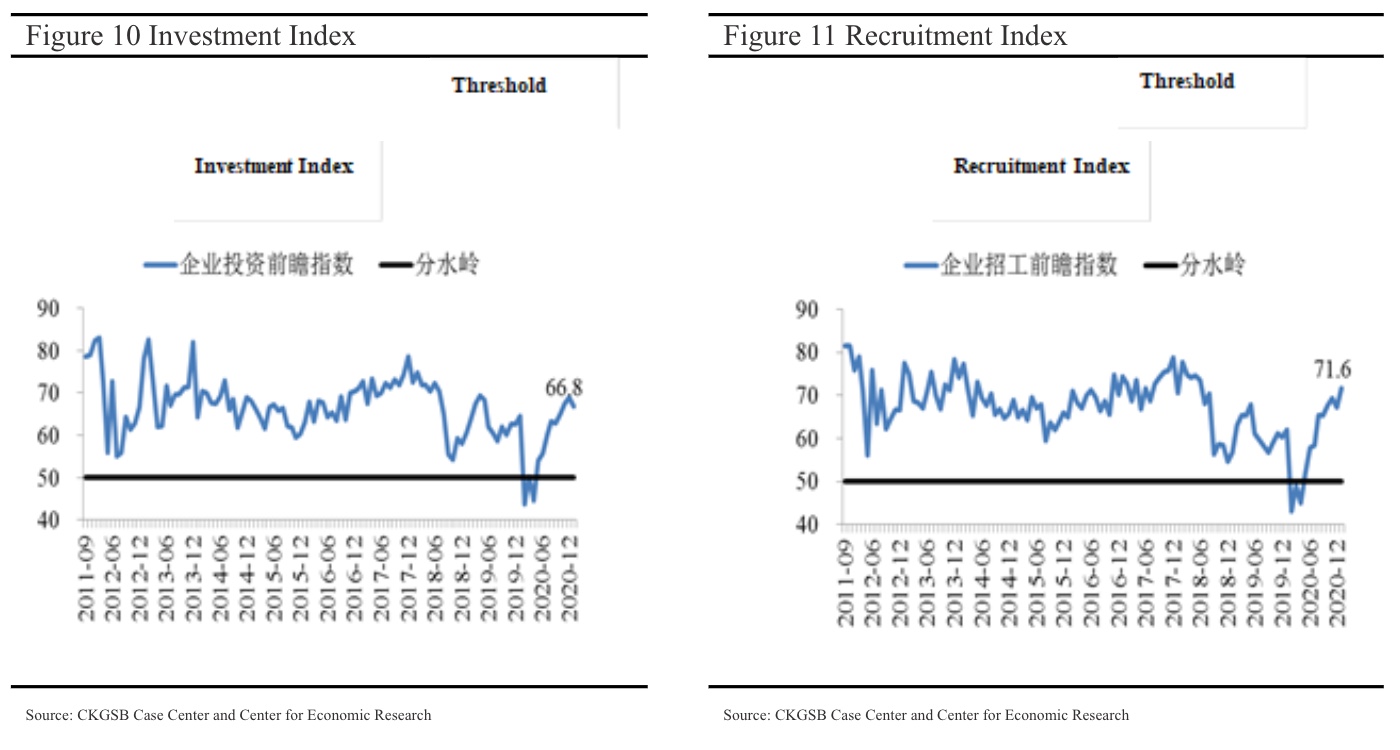

We now turn to investment and recruitment. These two indices have been consistently at the more confident end of the scale since the BCI began. In recent months however, both have weakened, especially recruitment, but this month one rose and one fell, with investment conditions on 66.8 from 68.9 (Figure 10), and recruitment prospects higher at 71.6 from last month’s 69.3 (Figure 11).

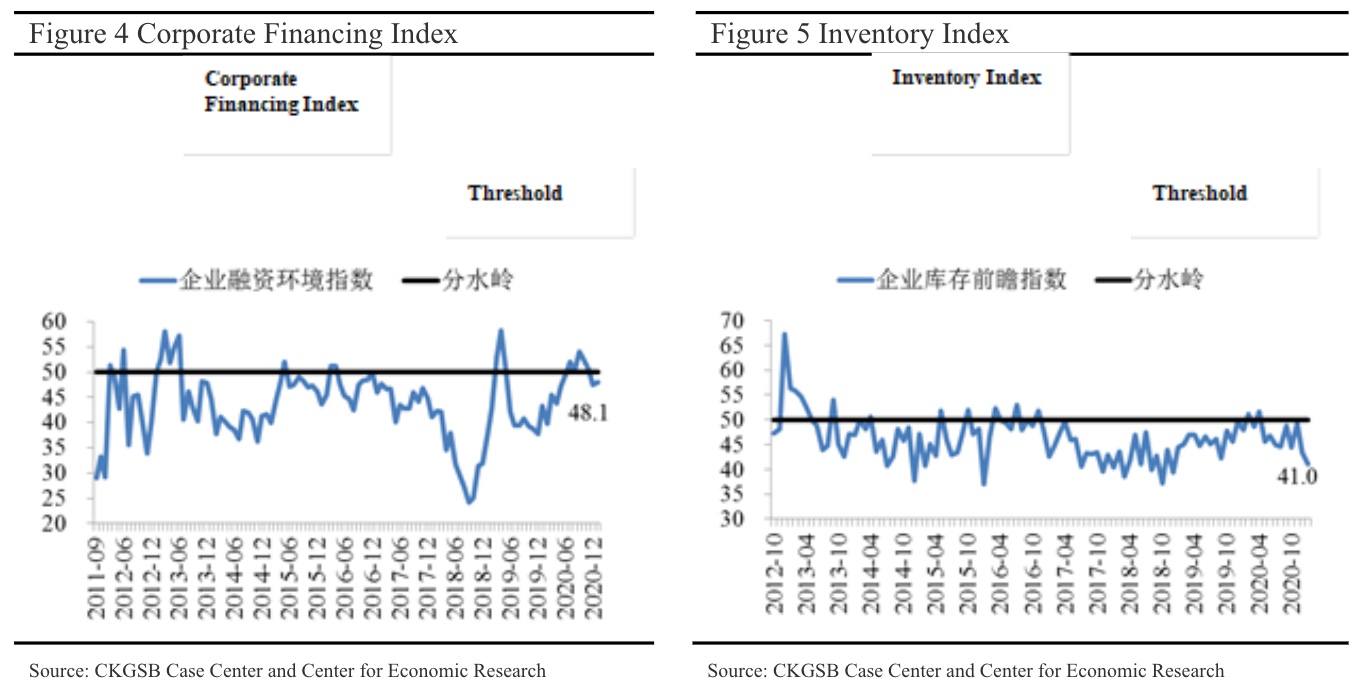

Finally, we include an index recording our sample’s relative strength in the marketplace. Figure 12 shows surveyed companies’ self-reported competitiveness compared with peers. As our sample mostly comprises of excellent private firms headed by CKGSB alumni, their competitiveness is higher than average (50 points) in their respective industries. This suggests that Chinese industry as a whole is facing a harder time in the near future than the BCI cohort.